The Consumer Data Right was always intended to facilitate economy-wide data sharing for consumers. With the release of today’s statement from Treasurer Josh Frydenberg MP and Paul Fletcher MP, this brings consumers one step closer to absolute ownership of their data and its usage.

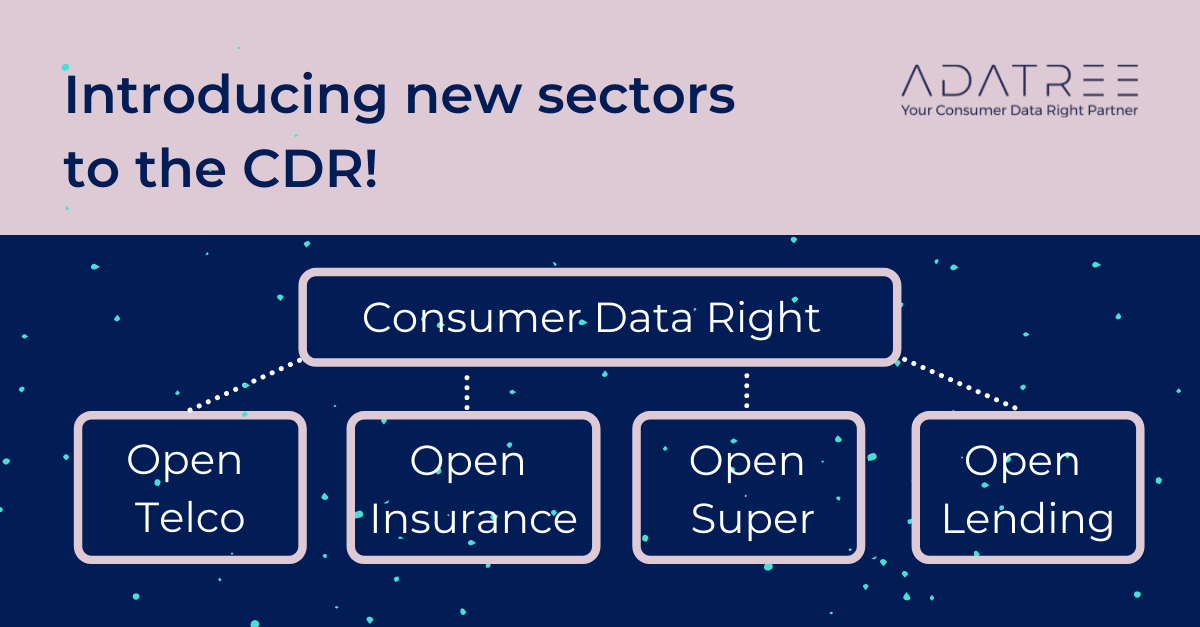

CDR has changed the state-of-play for consumer data in the Banking and Energy sectors, and as of today’s announcement that lens has widened – first to include the Telecommunications sector with the Finance sector to follow shortly thereafter.

Open Telco and Open Finance will complement the already existing Open Banking, with Open Energy expected to go live in November 2022.

‘Open Finance’ will bring the following industries into the CDR:

- Superannuation

- General insurance

- Non-bank lenders

- Merchant acquiring

“Introducing new sectors into the CDR ecosystem will have a major impact on everyday Australians. In the coming years, there will be hundreds of Data Holders participating in CDR. With the addition of these new sectors, the trajectory for consumers to secure better deals, save money and time, and have new services to simplify their life is going to expand exponentially.” Jill Berry, Adatree CEO

Why does it matter?

More transparency is great for consumers – but it also means a more competitive market, which drives innovation for the sector and our nation as a whole.

At its very inception with Open Banking, CDR was designed to give customers more control over their data, equating to more choice in the market and more convenience in managing their money, leading to greater consumer confidence in the use of one of our most valuable personal assets – our data.

What could CDR look like for Open Finance?

By extending CDR to include the Finance Sector, consumers will be able to aggregate information from multiple industries or vendors.

Take for example a consumer’s insurance portfolio. Open Finance means that, in the future, a consumer could potentially view all their general insurance policies – such as including health, car, home and TDD insurances – in one central location. Better still, an aggregator could provide smarter insights by analysing a consumer’s existing policies along with their personal and financial circumstances to suggest a tailored insurance portfolio that is comprehensive, higher performing or simply cheaper.

The possibilities for the sector are limitless. It could mean greater control over your superannuation investment preferences. It could mean greater visibility for consumers’ spending habits. Or at the very least, it’ll likely give all consumers a bit more time back in their day with smarter and more integrated finance apps that reduce life admin.

Australian business loves a chance to challenge the market and this shift will likely bring forth exciting innovation for the industry.

Ready to leverage CDR for your business?

Adatree will help you on your CDR journey, for any industry

Adatree was developed to be a Consumer Data Right platform, meaning that while we help our customers to ingest banking data, that’s just the beginning! Whether organisations want to access and leverage energy, telco, insurance, lending or merchant payment data, our proprietary CDR platform is architected to help you receive data across any industry.

To chat about how to access and leverage industry-wide data, get in touch at hello@adatree.com.au.

Read the full release from Josh Frydenberg MP Treasurer and Paul Fletcher MP Minister for Communications, Urban Infrastructure, Cities and the Arts: More power to compare and switch telco providers and share finance data