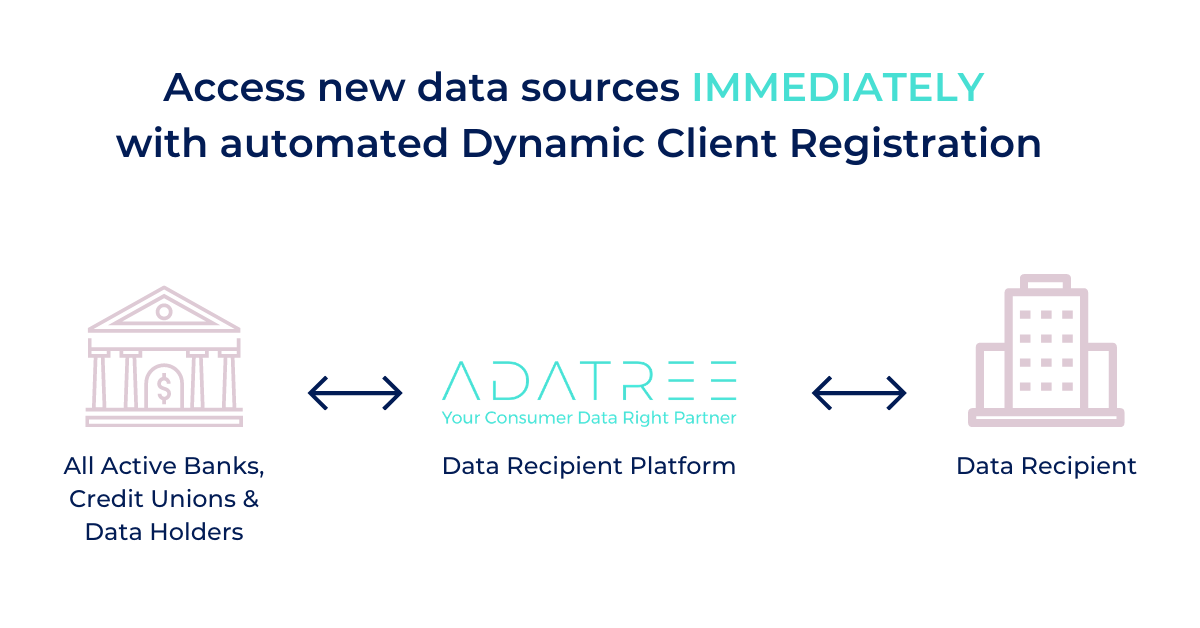

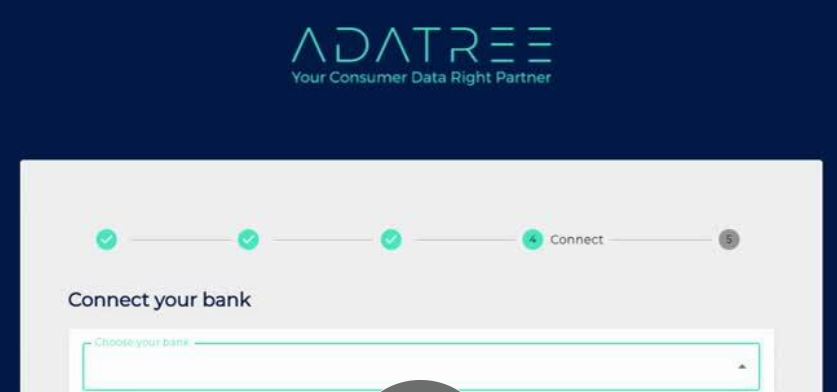

As of 4 August, Adatree is excited to announce that 34 out of 34 Data Holders are currently live in Adatree’s Data Recipient Platform. Our turnkey platform is 100% automatic, with no manual intervention required. This means it automatically adds and activates any new Data Holder so that our customers can start receiving data off the new Data Holders immediately.

{% video_player “embed_player” overrideable=False, type=’scriptV4′, hide_playlist=True, viral_sharing=False, embed_button=False, autoplay=False, hidden_controls=False, loop=False, muted=False, full_width=False, width=’1072′, height=’1076′, player_id=’52082714490′, style=” %}

Read More