Adatree, a SaaS provider of turnkey Open Banking technology, has signed the largest ever bank and fintech partnership which will enable a consortium of 20 Australian banks and credit unions to enter into the Consumer Data Right.

Adatree, a SaaS provider of turnkey Open Banking technology, has signed the largest ever bank and fintech partnership which will enable a consortium of 20 Australian banks and credit unions to enter into the Consumer Data Right.

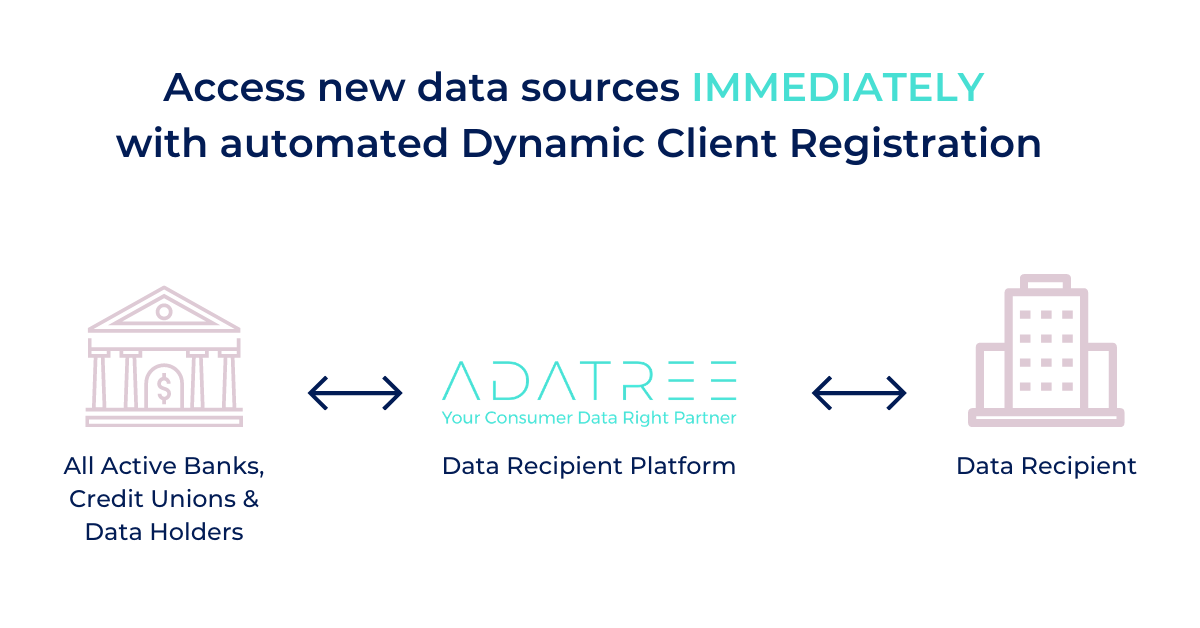

With Data Holders sharing consumer data with Accredited Data Recipients from July 2020, all other banks and credit unions, excluding foreign branches, have to start making consumer data sharing available from July 2021. Data Recipients want to ensure that they get immediate access whenever a new data source is available, and Adatree’s Data Recipient platform guarantees their seamless access.

Adatree, a SaaS provider of turnkey Open Banking technology, launches a new add-on data storage service for their Data Recipient customers.

Adatree, DNX Solutions, RSM Australia, Trend Micro and Fintech Australia launch their eBook, ‘Your Practical Guide to Being an ADR’, written in collaboration based on their hands-on experiences helping companies on their journey to being an Accredited Data Recipient (ADR).

Australian companies Adatree and DNX Solutions have partnered to provide a turnkey Consumer Data Right (CDR) SaaS and infrastructure solution for aspiring Data Recipients. Both solutions are “ready to go” infrastructure to provide simple and fast access to the CDR that suit all industries and use cases.

Adatree is often asked, “Why would I buy software to access the CDR instead of building the solution myself? How hard can consent be?”

Adatree introduces the ADR Accelerator, which includes all of the business and technical templates required for Accredited Data Recipient applications.

As of February 25, 2021, Adatree is officially accredited as an Accredited Data Recipient (ADR) by the ACCC. Adatree is the first startup to be accredited, the first company accredited with a female CEO, and the first purely CDR-focused technology provider.

Adatree is a Consumer Data Right technology provider of turnkey solutions to access and leverage CDR data, working with other companies to accelerate their own journey as an Accredited Data Recipient.

You want to build data-driven customer propositions, so how do you source that data? Historically it has been through screen scraping, but the introduction of the Consumer Data Right in Australia introduces a more reliable, customer-centric and comprehensive way to share data.

Australian Consumer Data Right platform Adatree has closed their $1.2M Seed funding round, which was nearly three-times oversubscribed.

Investors joining this round are Tyro Payment co-founder Peter Haig and Kerry Roxburgh, the longtime Tyro Chairman and Ramsay Health Care Director and current Chairman of Eclipx.